View:

May 02, 2024

FX Daily Strategy: Asia, May 3rd

May 2, 2024 9:00 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: APAC, May 3rd

May 2, 2024 3:12 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

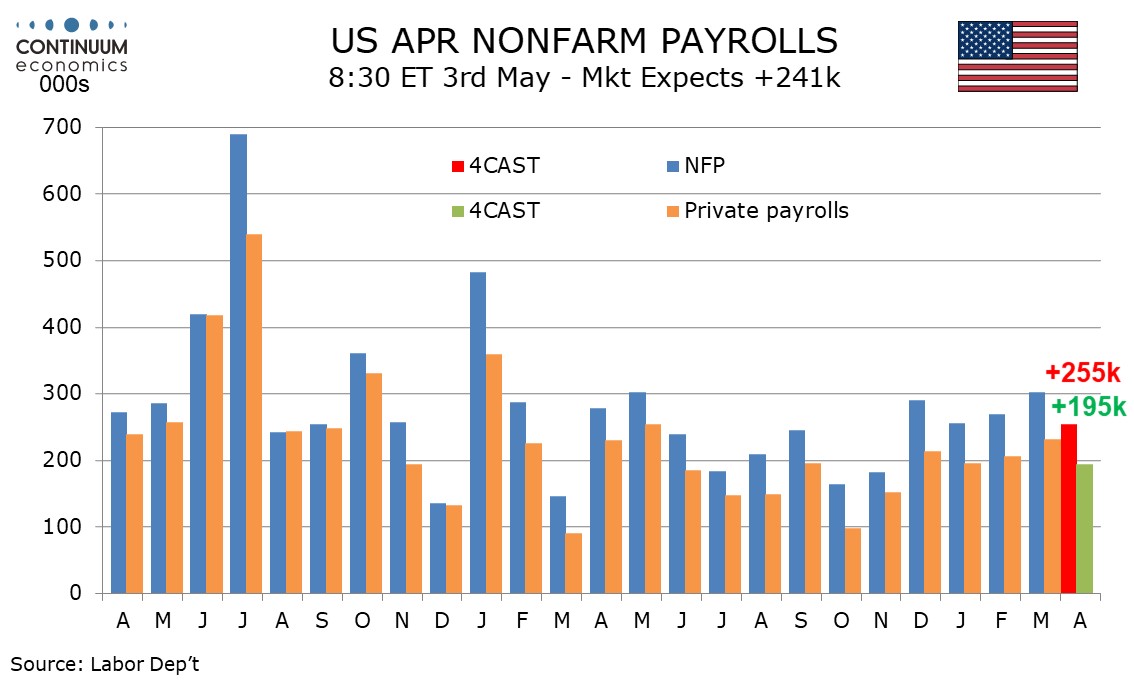

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

May 2, 2024 2:03 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

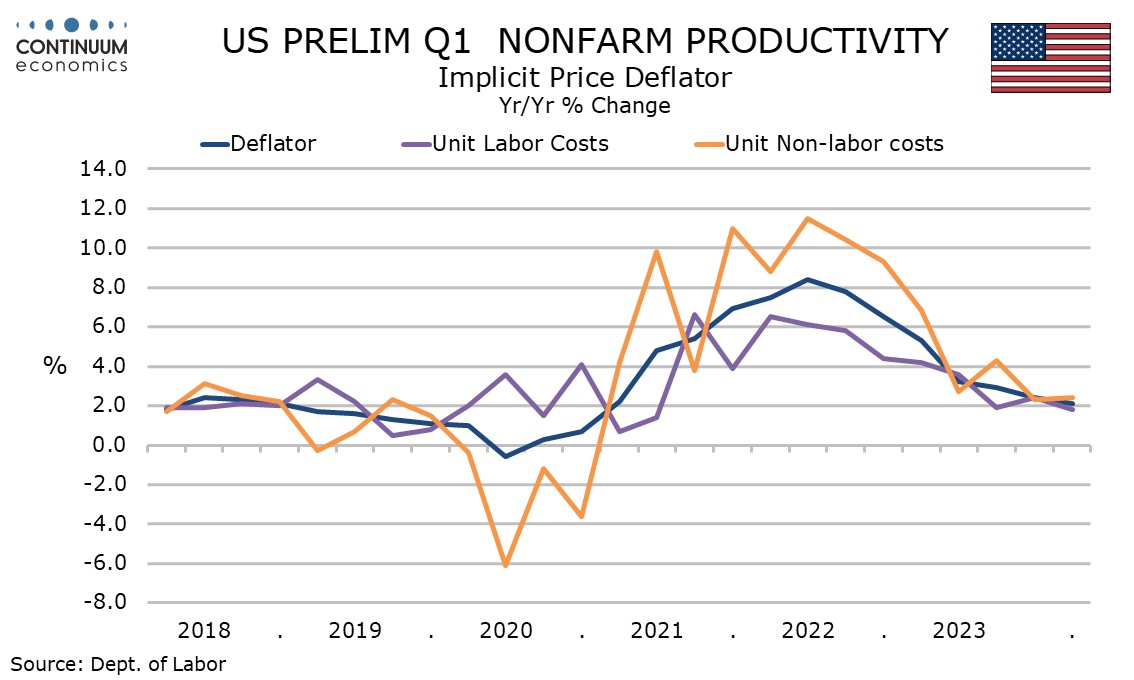

U.S. Unit Labor Costs and Initial Claims suggest inflationary risk from labor market strength

May 2, 2024 12:56 PM UTC

Initial claims at 208k are unchanged at a very low level while continued claims at 1774k are also unchanged, the preceding data revised from 207k and 1781k respectively. The labor market remains tight while unit labor costs saw a significant bounce to 4.7% annualized in Q1.

BoE Preview (May 9): Easing Bias Clearer?

May 2, 2024 11:06 AM UTC

In flagging no need to be dominated by Fed policy, we think that the BoE is not only moving towards rate cuts but the MPC majority may be overtly advertising such a likelihood. But we do not see any move at the looming May 9 verdict, with Bank Rate again likely to remain at 5.25%. But the accompan

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

May 01, 2024

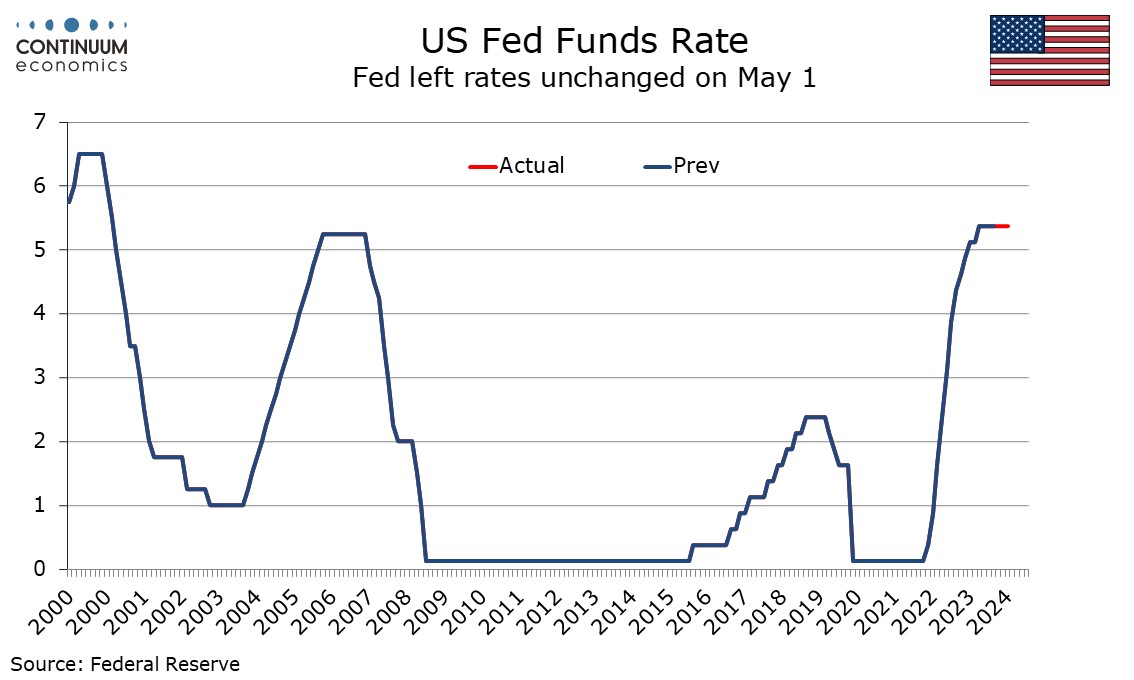

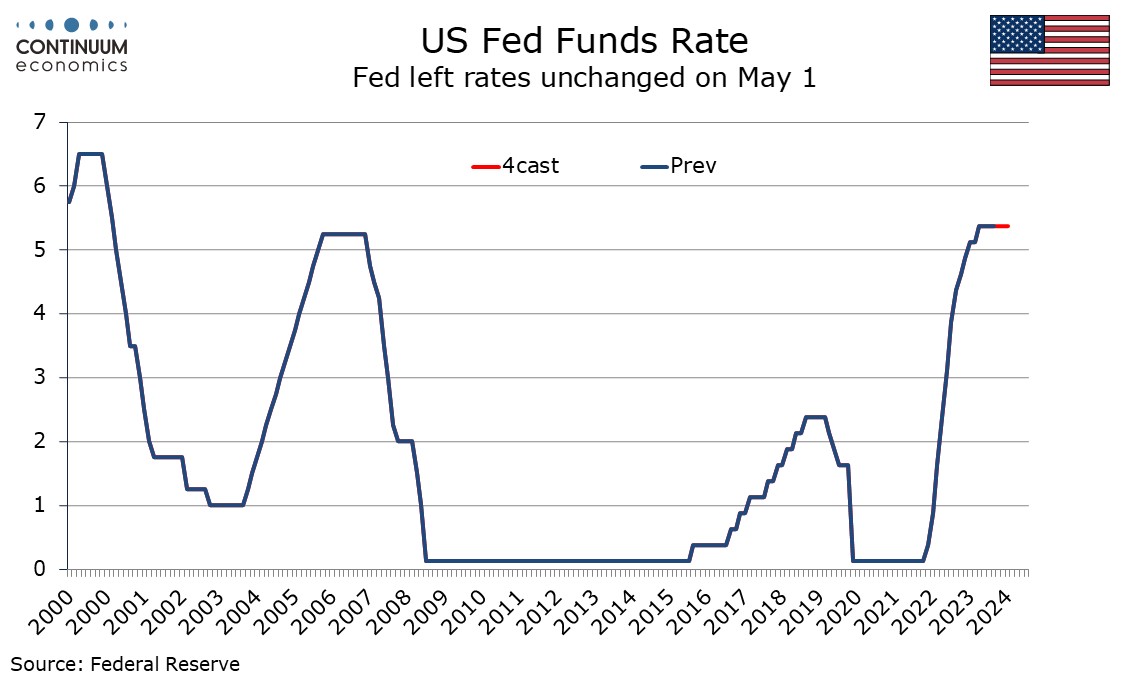

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

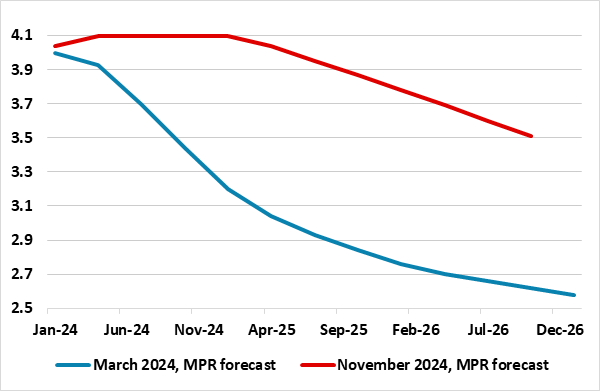

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

April 30, 2024

Mexico GDP Review: 0.2% Growth but Still Subpar

April 30, 2024 5:54 PM UTC

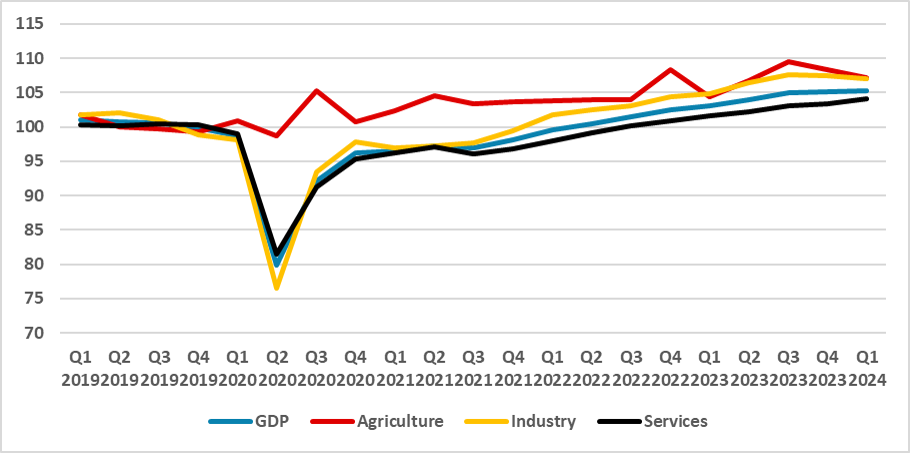

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Service

UK GDP Preview (May 10): Fragile Sideways-Moving Activity Continues?

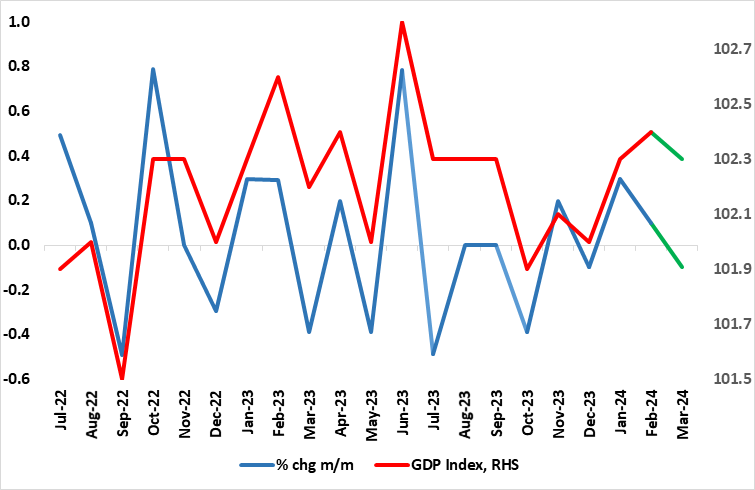

April 30, 2024 2:19 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

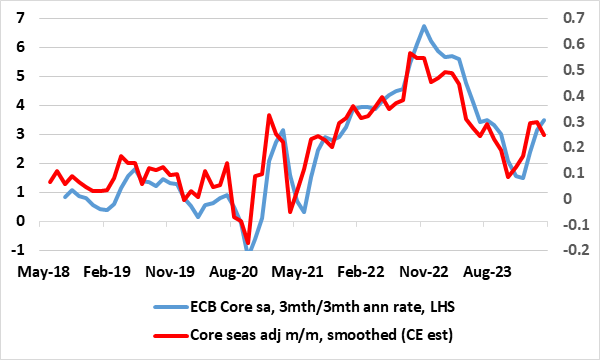

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex

April 29, 2024

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a